Federal Carbon Pricing System

The federal government has developed two carbon pricing mechanisms –

the federal fuel charge (often called the ‘pollution price’ or

‘carbon tax’) and the federal baseline and credit system for

industrial facilities. These programs are referred to as the

‘federal backstop,’ applying in provinces and territories without

their own carbon pricing programs.

Federal Fuel Charge (Carbon Tax)

As of April 1, 2024, the federal carbon tax is $80 per tonne of

CO2e, applied to fossil fuels based on carbon content. It was set to

increase by $15 annually to $170 per tonne by 2030. The tax applies

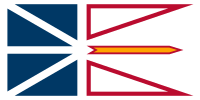

in Alberta, Manitoba, Newfoundland and Labrador, New Brunswick, Nova

Scotia, Ontario, Prince Edward Island, Saskatchewan, and partially

in Nunavut and Yukon.

Fuel Charge Rates (2024)

| Fuel |

Rate |

| Butane |

$0.1424 per litre |

| Diesel |

$0.2139 per litre |

| Gasoline |

$0.1761 per litre |

| Kerosene |

$0.2065 per litre |

| Natural Gas |

$0.2035 per cubic metre |

| Propane |

$0.1238 per litre |

Full list of fuel tax rates

Canada Carbon Rebate (2024)

Approximately 90% of funds collected are distributed back to

residents. Average individual: $516.92/year | Average family of 4:

$1,219/year.

Federal rebate schedule

Federal Baseline and Credit System (OBPS)

The Federal Output-Based Pricing System (OBPS) applies to industrial

facilities emitting over 50,000 tonnes of CO2e per year. Facilities

are given a baseline emission limit per unit of product. Examples:

- 650 tonnes CO2e/GWh (electricity from solid fuels)

- 0.216 tonnes CO2e/vehicle produced

- 0.0728 tonnes CO2e/tonne of potatoes processed

Facilities beating the standard earn credits; those exceeding it

must buy credits. OBPS applies in Manitoba, Nunavut, Prince Edward

Island, and Yukon.

Full OBPS standards

OBPS Regulations Overview

The OBPS Regulations (SOR/2019-266) define a facility as a site or

sites where specified industrial activities are carried out,

including oil and gas production, mineral processing, and

electricity generation. Key emission types quantified include

stationary fuel combustion, industrial process emissions, and

flaring emissions. The regulations set output-based standards (e.g.,

0.0159 CO2e tonnes/barrel for light crude oil production).

Facilities must submit annual reports detailing GHG emissions and

production, verified by an accredited body.

Post-Removal (April 1, 2025)

The federal consumer carbon tax is removed, ending rebates. OBPS

continues for industrial facilities, focusing on emissions over

50,000 tonnes CO2e/year.